FHA is short for to the Federal Construction Management. A keen FHA loan try a home loan that’s given by a keen acknowledged FHA bank and you can insured by the FHA in itself. Its readily available for lower in order to reasonable money consumers that have straight down credit scores and you may a lesser lowest downpayment. And this begs practical question, is FHA money assumable?

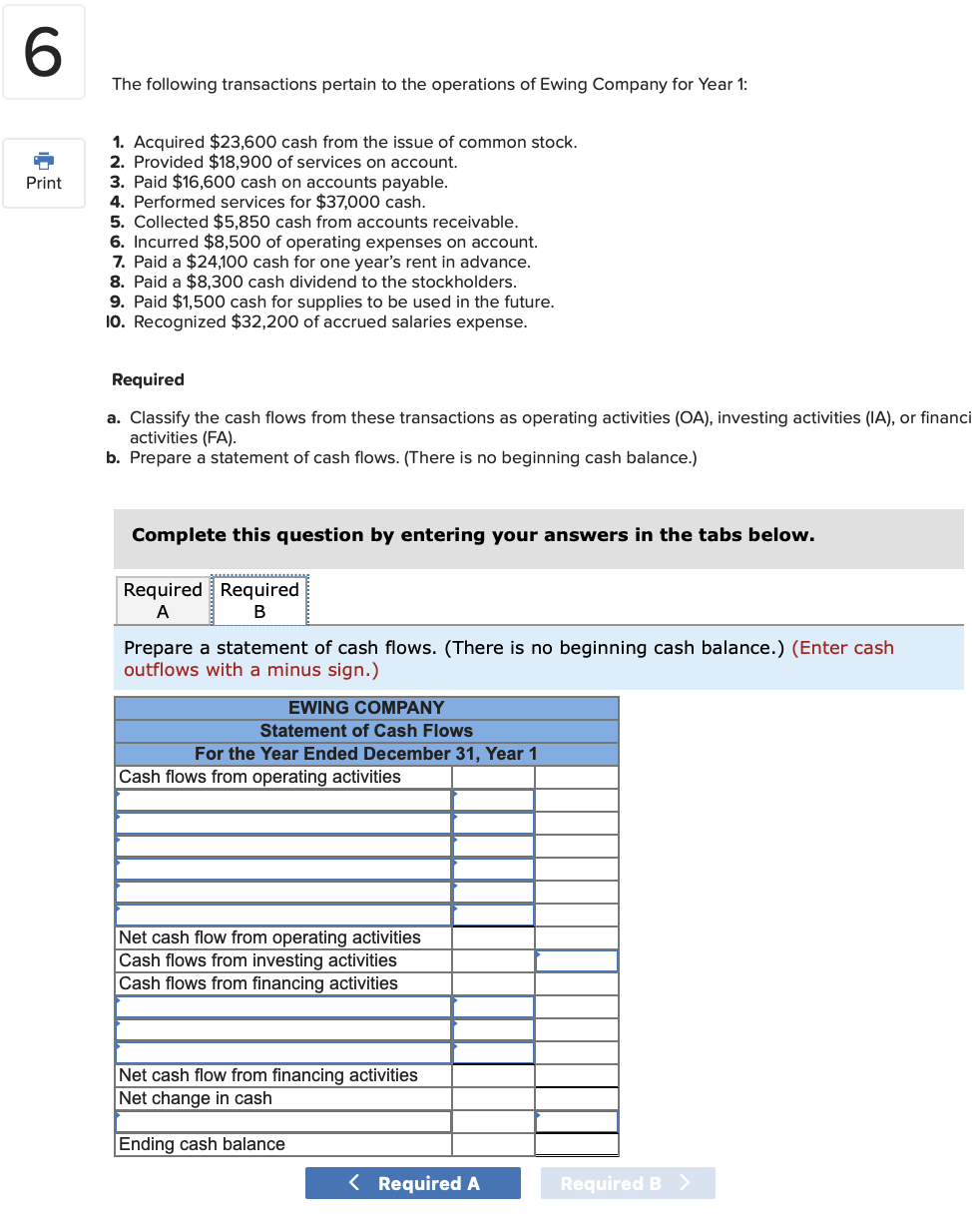

Are FHA Fund Assumable?

With regards to the Company out-of Construction and you will Metropolitan Innovation (HUD), all the FHA-covered funds try assumable in the event the this new debtor normally qualify for the borrowed funds in addition to existing financing has no constraints wear they.

Nowadays, you’ve got questions about FHA assumable funds and the ways to and acquire him or her. This short article outline all you need to understand FHA assumable fund as well as how it works.

A keen FHA assumable mortgage needs a credit score with a minimum of 600 (unlike a traditional financing which have to be seven-hundred or higher). Financial insurance for a lifetime are mandatory, unless you imagine that loan which was authored before specifications becoming adopted. A loans-to-earnings ratio regarding 43% (or quicker) is also required. Very, eg, for many who secure $5000 a month, the financial (or debt fee) don’t meet or exceed $2,150.

The theory trailing an assumable home loan is quite easy. Essentially, permits the house consumer for taking along side home loan out-of the seller, provided the borrowed funds lender approves they. Including, if the seller enjoys an assumable mortgage off $one hundred,one hundred thousand although residence is promoting for $150,100, then your buyer will need to assembled an extra $fifty,100 buying the house.

It is essential to notice, however, you to definitely whilst the buyer enjoys wanted to imagine the suppliers home loan, the lending company try permitted replace the terms of the brand new agreement, if necessary. Reasons for having so it often through the customers borrowing risk (which has the potential for default to the a financial obligation) and current market conditions.

That it prospects you in to another situation, that’s if or not incase an FHA financing is largely good for the vendor additionally the buyer.

Benefits of a keen FHA Assumable Mortgage

The sole date that it will get very theraputic for both consumer plus the provider is when the current financial prices try large versus mortgage and is assumed.

Instance, if for example the home try funded a decade in the past which have a keen FHA financing at a rate of 5%, nevertheless now the newest pricing try doing seven%, up coming and when this new manufacturers FHA loan shall be beneficial. In such a case, the consumer keeps an opportunity to purchase a property now which have the benefit of with yesterdays straight down rate. So it rates benefit setting the loan presumption brings additional value .

Some other benefit is if the original FHA loan was old early in the day to , the borrowed funds advanced is removed as the loan balance falls so you can 78% of your own brand-new cost. I suggest discovering our article on FHA mortgage insurance fees so you’re able to discover more.

The benefit with the supplier are they is able to find top dollar (or more) with the domestic considering the all the way down financial rate on their loan.

When your household worth has grown and you can/and/or seller keeps reduced a substantial amount of the mortgage equilibrium, then your visitors will demand an enormous down-payment.

Such as, our home originally marketed to possess $one hundred,100000 together with loan amount try $96,five hundred. Although not, today the latest price point into the residence is $125,000 additionally the financing equilibrium was $92,100000. Within condition, the buyer would need to arrived at closure having a straight down fee out-of $33,100000 that’s twenty-six% of your own price.

Contained in this circumstance more than, they may not add up to assume the latest FHA mortgage. You really have a down payment greater than 20% you you’ll be eligible for a conventional mortgage with no PMI.

Is actually a keen FHA Assumable Loan Harmful to the vendor?

FHA assumable financing tend to work with the buyer, but carry out nevertheless they benefit owner? More will cost you can befall the vendor which have an enthusiastic FHA mortgage. Yet not, the method, typically, isn’t any more complicated than just compared to a conventional mortgage.

Exactly why an enthusiastic FHA financing you certainly will perspective a challenge into the supplier is when it comes to the customer defaulting on the financing. Owner might getting liable to the lending company for all the a fantastic financial obligation perhaps not retrieved. This is exactly without a doubt something you perform be sure toward lender previous in order to moving on.

A lot more costs are obtain by seller if any extra repairs need to be produced. The house functions as security on FHA- assumed loan and therefore need see certain livability criteria. If you don’t, the brand new onus drops up on owner accomplish any required solutions in order for the home to successfully pass inspection.

The newest evaluation is performed by the an FHA-accepted appraiser, so it is vital the vendor support the domestic during the tip-good shape. Inability to take action you’ll slow down the fresh new intimate out of escrow, possibly evoking the death of marketing.

FHA Assumable Mortgage Factors

As of the present day year, an enthusiastic FHA loan lets the fresh debtor as much as 96.5% off a houses well worth. These types of money is actually assumable simply by the people that https://paydayloanalabama.com/penton/ have an excellent FICO get of at least 600. In such a case, the buyer need certainly to glance at the exact same acceptance processes the guy or she would to possess a unique FHA financial.

A note from caution, never go into a contract by which anybody else can assume your own financial instead a loan provider. In the event that, such as for instance, the seller allowed the buyer to simply move around in and also make money, he or she do fundamentally become the land lord, however guilty of the property and you will, of the expansion, the loan. This should not experienced an enthusiastic assumable mortgage that will enjoys major financial effects, so be careful!

FHA Loan Misconceptions

A familiar misconception having FHAs involves the proven fact that because the loan is assumed, the first proprietor is liable because of it. To the contrary the initial borrower isnt accountable for the balance in the event the appropriate assumption import documents has been properly completed.

FHA Finance Assumption Closing costs

There was a bonus so you can of course, if FHA fund and this involves closing costs costs. In many cases the lending company out-of an FHA-accepted mortgage commonly charge you that is notably less than simply compared to a traditional mortgage.

Very conventional funds wanted to 20% off while FHA mortgages require much less merely step 3.5%. Additionally, many closing costs is also as part of the loan, towards accessibility to paying any of these can cost you away-of-pocket.

Completion

To close out, FHA fund are undoubtedly assumable in the event your the fresh new debtor match the FHA loan official certification . FHA assumable financing will be a viable selection for very first time homebuyers based upon possible for example of course a keen FHA loan doesn’t seem sensible for everybody. Even with the chance of a lowered interest, you will be best off making an application for a unique FHA loan.