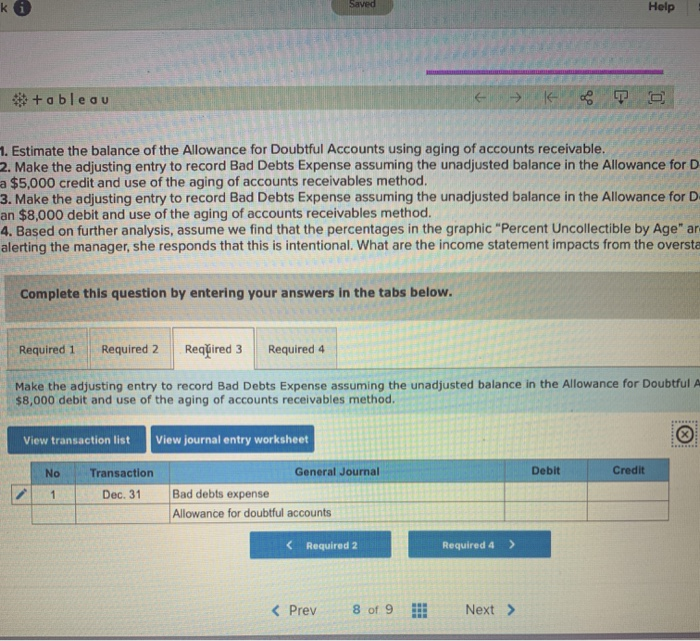

So you should do everything you can to avoid losing money on customers who don’t pay their invoices. For example, say on December 31, 2022, your allowance account shows a credit balance of $2,000. You calculate your allowance using the accounts receivable aging method shown above and decide your allowance should be $5,750. Note that the debit to the allowance for doubtful accounts reduces the balance in this account because contra assets have a natural credit balance. Also, note that when writing off the specific account, no income statement accounts are used.

Financial Accounting Standards Board (FASB)

However, the actual payment behavior of customers may differ substantially from the estimate. The percentage of credit sales method directly estimates the bad debt expense and records this as an expense in the income statement. In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial reports. The projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses.

- Before this change, these entities would record revenues for billed services, even if they did not expect to collect any payment from the patient.

- The sales method estimates the bad debt allowance as a percentage of credit sales as they occur.

- Companies use the allowance method to estimate uncollectible accounts and adjust their financial statements to present an accurate picture of their financial position, specifically cash flow.

- Before the doubtful account is written off, the profitability of the transaction in question appears higher than it will be when the bad debt expense is finally added.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- Allowances for doubtful accounts are an important tool to help cover inevitable dummy non-payments.

Pareto Analysis Method

This means the company has reached a point where it considers the money to be permanently unrecoverable, and must now account for the loss. However, without doubtful accounts having first accounted for this potential loss on the balance sheet, a bad debt amount could have come as a surprise to a company’s management. Especially since the debt is now being reported in an accounting period later than the revenue it was meant to offset. And, having a lot of bad debts drives down the amount of revenue your business should have.

What Is Equity, and How Do You Calculate It?

In this example, assume that any credit card sales that are uncollectible are the responsibility of the credit card company. It may be obvious intuitively, but, by definition, a cash sale cannot become a bad debt, assuming that the cash payment did not entail counterfeit currency. With this method, accounts receivable is organized into categories by length of time outstanding, and an uncollectible percentage is assigned to each category. For example, a category might consist of accounts receivable that is 0–30 days past due and is assigned an uncollectible percentage of 6%. Another category might be 31–60 days past due and is assigned an uncollectible percentage of 15%.

The adjustment process involves analyzing the current accounts, assessing their collectibility, and updating the allowance accordingly. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. Publicly traded companies are required to follow GAAP rules, so some small businesses follow GAAP if they plan on growing and potentially going public someday. Note that if a company believes it may recover a portion of a balance, it can write off a portion of the account. Our team is ready to learn about your business and guide you to the right solution.

Allowance Method Estimates

Dell’s bad-debt-expense-to-write-off ratio (see Exhibit 2) for the nine years from 2000 to 2008 is 1.15, which is reasonably close to the benchmark of 1.0. Although Dell exhibited two years of possible overestimation in relation to actual write-offs in 2000 and 2001, the company has more closely matched bad debt expense with write-offs since 2002. Exhibit 1 uses three years of data from Dell Inc. to describe three simple techniques for assessing past estimates of the allowance for doubtful accounts. Because the techniques use historical data, they give an indication of the effectiveness of past estimates. All data used in this article is available in these companies’ filings at sec.gov. When a lender confirms that a specific loan balance is in default, the company reduces the allowance for doubtful accounts balance.

This amount is referred to as the net realizable value of the accounts receivable – the amount that is likely to be turned into cash. The debit to bad debts expense would report credit losses of $50,000 on the company’s June income statement. Regardless of company policies and procedures for credit collections, the risk of the failure to receive payment is always present in a transaction utilizing credit. Thus, a company is required to realize this risk through the establishment of the allowance for doubtful accounts and offsetting bad debt expense. In accordance with the matching principle of accounting, this ensures that expenses related to the sale are recorded in the same accounting period as the revenue is earned.

The allowance for doubtful accounts also helps companies more accurately estimate the actual value of their account receivables. An allowance for doubtful accounts, or bad debt reserve, is a contra asset account (either obscure scholarships for college has a credit balance or balance of zero) that decreases your accounts receivable. When you create an allowance for doubtful accounts entry, you are estimating that some customers won’t pay you the money they owe.