Strong development in FHLB insurance provider membership and borrowings

Limit credit limits to own improves are different of the FHLBank, but commonly fall anywhere between 20% and you may sixty% out-of full property. User improves pricing repaired otherwise floating rates across good selection of maturities, away from at once so you can 30 years. According to the newest FHLBank Work environment from Financing individual presentation 2400 dollar loans in Cannondale CT, floating-speed improves had been just more than 31% away from full advances by . New maturity away from advances possess reduced in conjunction with this particular development into a floating speed: More than ninety% of advances dropped within the reduced-than-one four-12 months range by the end out of 2023, a twenty-five% increase more 2021. If you are costs are regularly updated and you may disagree across banks, Figure step 1 listings a sample off prices by .

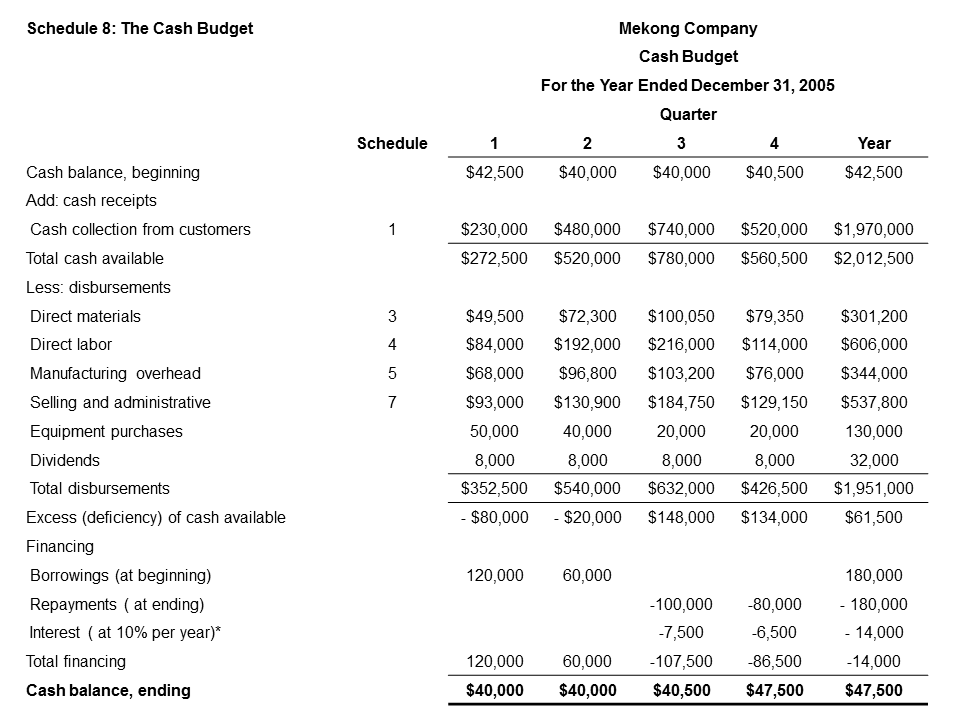

Profile 1

So you can cash in enhances, consumers need buy pastime-dependent FHLB stock also the stockholdings required for registration. The new FHLBank Work environment out-of Fund cites a routine price away from cuatro% 5% out of principal borrowed. Each other subscription and you may craft-built stock types promote dividends. So it financial support is commonly gone back to the fresh associate via stock buyback given that progress are paid back. Enhances are also required to be completely collateralized because of the bonds otherwise loans; certain standards getting such guarantee will vary from the local FHLBank as well as the possible borrower’s credit status. Typically, eligible guarantee must be single-A ranked otherwise significantly more than and you may homes-related. This could is: Us Treasuries, institution obligations, department and you may low-agency MBS, industrial MBS, civil bonds (that have research these particular are housing-related), cash, deposits in an FHLBank, or other actual-estate-related possessions.