Both top alternatives for basic-date homebuyers is antique and Government Houses Administration (FHA) funds. Each financing has actually advantages and disadvantages to look at.

What’s an FHA loan?

FHA-approved lenders is also thing fund which can be covered of the Federal Property Administration and therefore are best for people in search of low-down percentage solutions, versatile earnings and credit recommendations.

Old-fashioned finance aren’t covered otherwise secured from the bodies firms. They are often available with fixed otherwise adjustable-rates terms and conditions, and can even require higher fico scores and you may off payments than simply FHA fund.

Differences between FHA and you can conventional finance

There are numerous secret differences between conventional and you may FHA funds. Think about the pursuing the whenever choosing just the right financial for the state:

- Being qualified getting loans

- Possessions requirements

- Possessions brands

- Downpayment conditions

- Private home loan insurance rates

- Loan limits

Qualifying to have money

It’s easier to be eligible for an FHA financing compared to a traditional loan while the consumers might have a lower credit history and you can a higher debt-to-income (DTI) proportion than the a normal mortgage. not, applicants with a lesser credit rating and better DTI proportion can get nonetheless qualify for a traditional financing. In this case, lenders would think additional factors such as income and you may downpayment.

Assets standards

Possessions appraisals to own FHA funds resemble old-fashioned money. Appraisers gauge the assets to have value, soundness out of framework and cover. FHA appraisers must make sure it meets FHA Lowest Possessions Standards. To have old-fashioned financing our home Valuation Code of Conduct handles the latest conditions, protecting appraisers out-of agent and you will financial influence.

Possessions models

Lenders plus check just what consumers intend to use the house to have. FHA fund need the debtor to live in our home as the primary quarters, so they can not put money into otherwise flip characteristics. That have traditional fund, somebody can obtain different property brands including individual residential property, investment services and travel homes.

FHA finance are tempting to possess homeowners just who can not generate a large down payment. That have FHA funds, buyers could possibly set as low as 3.5% off. Traditional fund regularly need at least down-payment regarding 20%. But not, particular lenders now provide antique funds which have only step 3% off.

Home loan insurance coverage

Whenever homeowners set less than 20% down on installment loan Central a traditional financing, nevertheless they you would like personal financial insurance rates (PMI). Having FHA fund, borrowers have to pay mortgage insurance fees (MIP) it doesn’t matter what far they establish. PMI and you can MIP manage lenders off monetary losses should the borrower default to their mortgage. Superior try calculated and you will applied differently based whether the loan was antique or FHA.

Those with an FHA loan will pay one another initial and you can monthly superior. FHA funds use a single-size-fits-all the superior rates calculation, which may stay in impression toward longevity of the borrowed funds.

Which have conventional finance, individuals constantly shell out a month-to-month or unmarried PMI advanced. Affairs like credit score and downpayment let influence the fresh PMI rate. PMI comes to an end for traditional money if borrower is located at 78% loan-to-well worth proportion.

Mortgage limits

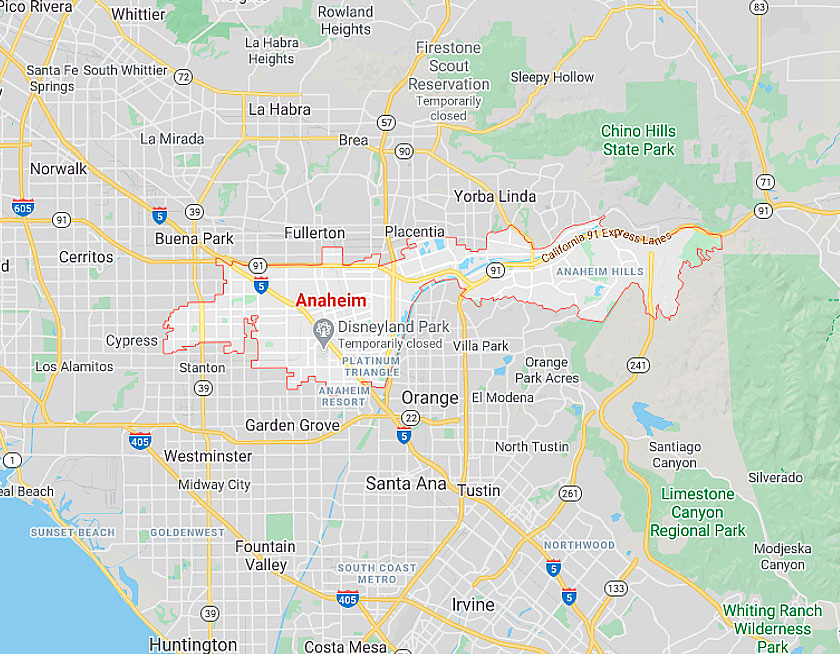

When you compare FHA and you may antique finance, it is essential to note that one another particular funds limit the number you could use. Maximum financing numbers are very different by condition, and they restrictions constantly transform each year.

Old-fashioned mortgage loans need to satisfy loan restrictions lay by the Government Homes Fund Company. Such limits are usually the same no matter where you’re to acquire property, with the exception of certain higher cost areas.

FHA financial limits will vary by the state where in actuality the possessions you may be buying is based and are usually below conventional limits.

FHA mortgage conditions

- Meet up with the minimum credit rating requirement, and therefore varies from the lender

- Uses our home because their no. 1 home

- Provide proof of a job and you will constant earnings

Possible barriers

Lenders will feedback your credit report during the underwriting procedure, so and make money punctually often replace your chances of are accepted. However, some things helps make delivering a loan more complicated, including:

Federal debt, collections and judgments: FHA loans usually require these to be paid off either before or by closing, or have an existing repayment plan with a satisfactory payment history. It’s important to choose a mortgage that meets your financial situation and future goals. Our house lending advisers can answer any questions and help you find the right loan for your needs.