Because of the securing a beneficial USDA loan , consumers can potentially take pleasure in economical monthly obligations and you may faster total can cost you

Lenders typically look for a credit rating of at least 640 or maybe more, even though some could possibly get undertake down ratings with an increase of records otherwise compensating circumstances. A good credit score demonstrates financial obligations and certainly will increase your likelihood of delivering acknowledged to have a great USDA financing .

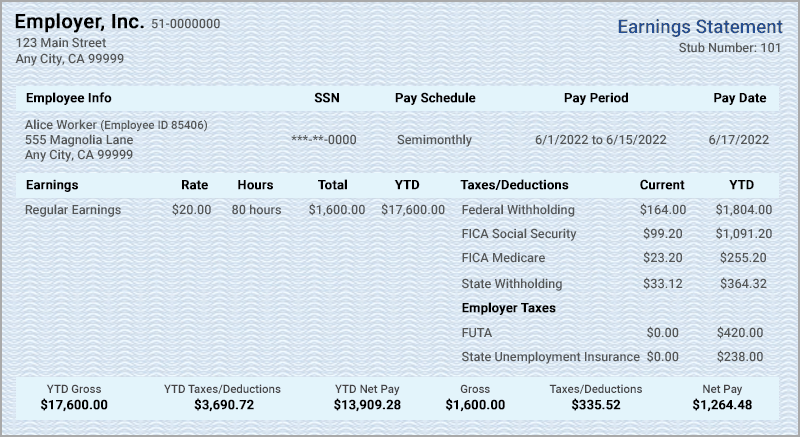

In addition, individuals need to have indicated secure and proven money so you can meet the requirements for a great USDA loan . Loan providers tend to feedback your own employment record, income supplies, and you may personal debt-to-money ratio to evaluate your ability to settle the loan.

Having a steady job or revenue stream can also be boost your software while making you an even more attractive applicant having acceptance. You’ll want to have all called for paperwork in a position when applying to possess an excellent USDA loan , such taxation statements, spend stubs, lender statements, and just about every other economic suggestions which might be needed for the financial process .

Among the secret great things about getting an effective USDA loan is the option to own 100% resource, which means individuals can buy property without having to create a down payment. This particular feature is very beneficial for basic-time homeowners or people with limited offers. At exactly the same time, USDA loans have a tendency to have lower interest rates as compared to traditional loans, making them an attractive choice for borrowers seeking to save money over the lifetime of the home loan.

A different advantageous asset of USDA money is because they have versatile borrowing from the bank conditions, making it easier for folks which have less-than-primary credit in order to qualify.

This really is specifically beneficial getting individuals whom may not meet brand new strict credit history requirements necessary for other types of fund, like FHA or old-fashioned fund. On the other hand, USDA financing don’t have specific money constraints, allowing a bigger a number of candidates so you can meet the requirements based on their novel economic factors.

That it independence from inside the borrowing from the bank and you will earnings conditions kits USDA financing aside as the an inclusive and you will accessible choice for of several potential homebuyers. On the flip side, one potential downside of USDA financing is they are just readily available for attributes situated in appointed rural areas.

Which geographical restriction will get limitation certain borrowers’ alternatives in terms so you’re able to going for a house inside their need place otherwise distance to help you locations. Simultaneously, whenever you are USDA financing render competitive rates of interest, they are doing require initial and ongoing charge such as for example mortgage insurance coverage superior and ensure costs.

These types of extra will cost you should be considered of the prospective individuals whenever researching the overall cost out-of an effective USDA loan than the most other funding choices particularly FHA or Virtual assistant fund. Consider the pros and you may downsides of a good USDA loan is a must from inside the deciding if it aligns together with your monetary goals and you will homeownership fantasies.

Once the great things about 100% investment minimizing rates generate USDA fund a fascinating possibilities for almost all buyers, activities like assets location limits and you can associated charge must also be studied into consideration when designing a knowledgeable choice regarding your mortgage financing choice. Talking to an informed loan officer such Casey Van Winkle from World class Mortgage provide valuable information into the whether or not a beneficial USDA financing ‘s the correct fit for your specific need inside wide spectrum of jumbo loan affairs or refinancing alternatives available in the current aggressive mortgage business.

USDA Financing against Conventional Mortgage

When you compare a good USDA loan so you can a traditional mortgage , it is important to comprehend the key differences when considering those two designs off mortgages. A traditional financing is probably not backed by an authorities department such as the USDA, FHA, or Va how do you pay interest on a single payment loan. It is offered by individual loan providers and you can employs assistance lay by the Fannie mae and you will Freddie Mac.