- History, compensatio morae is additionally called common standard. That it relates to a situation where both the borrower and you will creditor have standard when you look at the mutual financial obligation. As an example, from inside the a-sale package, in the event the provider doesn’t supply the merchandise and consumer does not afford the price, one another meanwhile, this could be compensatio morae.

This type of rules are essential in the determining accountability and you may treatments inside contractual disputes. In the civic rules times, this type of around three figure out which group is at blame, about what education, and you can exactly what effects is go after.

General Effects of Defaulting

The following list is based besides for the brand of mortgage you will be defaulting towards the your credit score, websites worth, quick assets, and you will courtroom updates with your loan package. We shall evaluate so much more specific results of defaulting to your particular items regarding debt later.

- Credit history Wreck: Defaulting toward financial obligation you will honestly feeling your credit rating. Late money and non-payments are reported to help you credit reporting agencies and can stick to your credit history for eight many years. Which all the way down rating causes it to be hard to see the credit otherwise loans and certainly will cause highest rates into the future borrowing.

- Suit: Financial institutions could possibly get sue that get well the debt. When they victory, they could see a view up against you that may trigger wage garnishment, family savings levies, or possessions liens.

- Range Situations: The debt is marketed so you’re able to a collection agencies. This type of firms will be aggressive inside their pursuit of percentage, usually and also make regular calls and you may giving characters.

- Asset Seizure: To possess secured bills instance mortgage loans or car and truck loans, the financial institution can get repossess the advantage. This means you could potentially lose your residence in order to property foreclosure or your own auto so you’re able to repossession.

- Employment Issues: Particular employers have a look at credit reports included in its hiring techniques. A default on your credit history might perception your work candidates, especially in areas for example financing or people requiring defense clearances.

- Housing Pressures: Landlords tend to see credit history when evaluating leasing apps. loans Deland Southwest FL bad credit A default helps it be much harder to help you rent a flat or domestic otherwise may require one to pay big safety dumps. An identical can be stated for mortgage loans hence want substantiation from a economic reputation just before a mortgage shall be safeguarded.

- Highest Insurance costs: In certain claims, insurance providers explore borrowing-situated insurance policies results to choose premium. A default can result in higher costs to have car, home, and other sort of insurance policies.

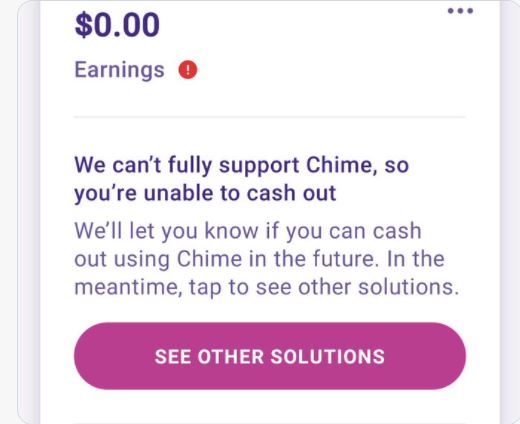

- Complications Starting Bank accounts: Specific finance companies play with ChexSystems or comparable attributes in order to monitor candidates getting the membership. A history of defaulted debts can make it difficult to open the brand new bank accounts.

- Income tax Outcomes: In the event that an obligations is forgiven or canceled, the fresh new forgiven matter is generally experienced taxable earnings of the Irs. This may end in an unexpected tax bill, then perpetuating financial strife.

Defaulting to the a student loan

Student loans is actually a different sort of personal debt. Defaulting toward a student loan provides the exact same outcomes since weak to settle credit cards, inside your credit score, your credit score, plus future loan candidates. Those who default towards the federal college loans may face wage garnishment.

Basic You are «Delinquent»

The loan is commercially outstanding whether your percentage try 90 days delinquent. Its reported to all or any around three significant credit bureaus so that your borrowing get commonly slide. This new borrowing from the bank apps tends to be refuted otherwise recognized here at good highest rate of interest that is certainly charged to help you riskier individuals.

A bad credit score can realize you in other ways. Prospective employers and you can prospective landlords commonly see the credit scores off people, specifically staff that will you desire a protection clearance to execute new employment.