At the same time, pros that have previous bankruptcy or foreclosures routinely have to wait an excellent particular several months in advance of getting entitled to a great Va financing (usually regarding 24 months).

When you are a veteran and you’ve got poor credit, don’t worry. You could potentially nonetheless sign up for payday loans Lockhart veterans mortgage brokers! Va finance to possess bad credit are you are able to.

- Look at your credit report Before you apply for a loan, check your credit file to have problems. Share with the credit agency if you learn people mistakes to simply help your credit rating.

- Run your borrowing today Even though you has bad credit, it is possible to raise they. For example paying off outstanding costs, using your debts timely, and you can restricting this new borrowing applications. The better your borrowing from the bank, the much more likely you can easily be eligible for pros home loans and have now a far greater interest.

- Spend less for a deposit Even although you don’t need a downpayment to have an excellent Virtual assistant home loan, it does remain of good use. For many who save money having a deposit, you will get a lesser rate of interest and become more appealing in order to loan providers.

- Rating pre-approved First in search of property, it is best locate pre-acknowledged having a veterans mortgage. This will assist you the amount of money you can acquire and you will make to invest in property easier.

- Play with a good Va-acknowledged financial Not all the loan providers can handle experts home loans, therefore make sure you find one that’s Va-approved. These firms understand guidelines and you will direction having Virtual assistant money.

- Tell the truth and you may clear Once you sign up for that loan, tell the truth concerning your credit rating and you will finances. Loan providers have a tendency to enjoy the sincerity that will become more prepared to help.

- Look for an excellent cosigner While you are having trouble taking a pros financial in your very own, query a close relative or buddy which have good credit so you can co-sign the mortgage to you.

7. How can i submit an application for a beneficial Va homes loan?

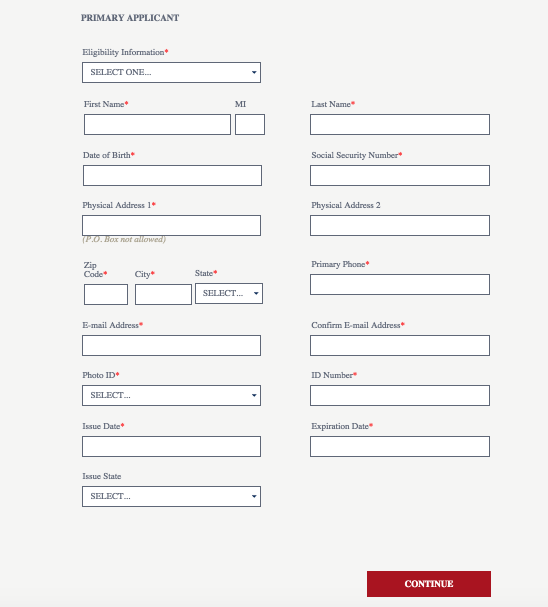

The first step inside making an application for an effective Va construction loan is to try to get a certificate from Qualification (COE) from the Va. A beneficial COE verifies your qualified to receive good Virtual assistant mortgage and that is necessary for the lending company to help you techniques the job.

You can buy a great COE by applying as a consequence of eBenefits otherwise inquiring the lending company you happen to be working with to acquire you to definitely.

After you’ve their COE, you are willing to submit an application for an effective Va financial. You will have to manage a lender which is authorized by the Virtual assistant to do this. Brand new Va deals with a good amount of banking institutions, so you should be able to find one that you love.

Just what information will the financial institution you desire off me?

- How much cash you create

- Simply how much we need to dedicate to a house

After you have used, the financial institution look at the app and determine once they have to make you a loan. They’ll show what kind of cash you could potentially borrow if they would.

The latest Va set specific guidelines that lenders need to realize whenever granting Virtual assistant fund. However, sooner, it is as much as the lender to determine whether to agree your loan.

The fresh new Va Financial Financing Percentage

When the acknowledged, you’re going to have to spend a great financial support percentage after you romantic towards loan. This will be a charge that Virtual assistant fees to help protection the expense of the loan. From inside the 2023, Va financing charge include .5% to 3.6% of your total cost of your mortgage, but you can lookup the rate into VA’s website. The speed may differ about how exactly far (or no) out of a down-payment you are and.